From Compliance to Operations:

Survey on Credit Dispute Management

Survey on Credit Dispute Management

PMG surveyed 129 industry professionals on dispute management. We asked about their biggest challenges, how regulatory changes could impact them, and what the future may hold.

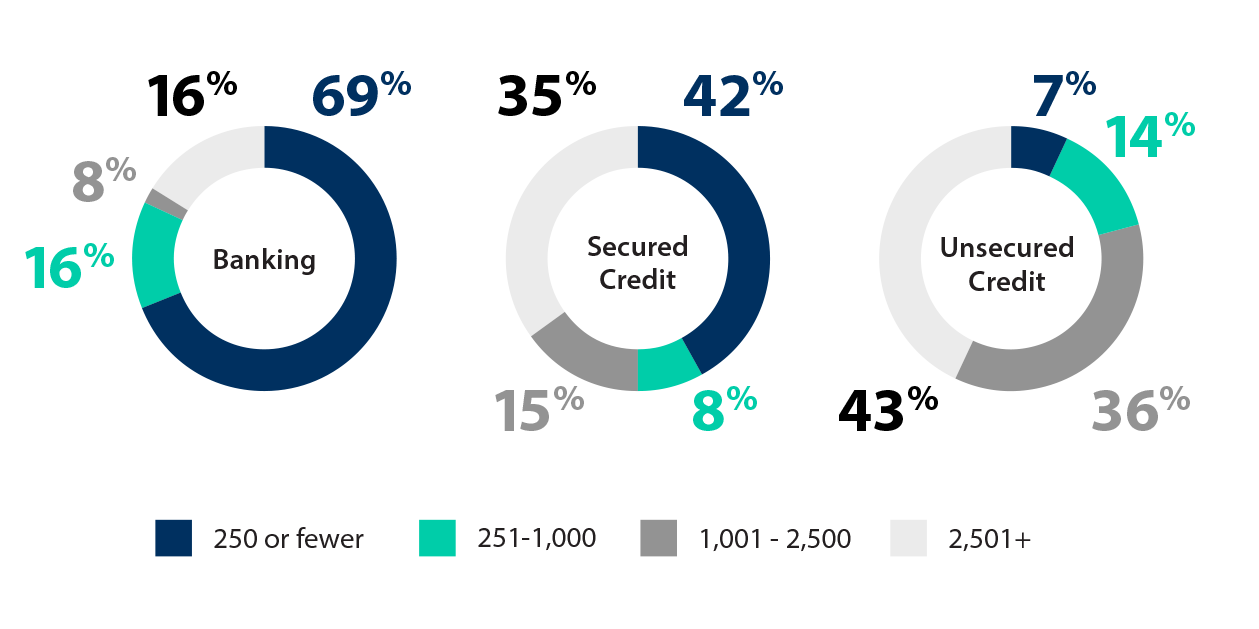

Respondents represented a broad cross-section of industry stakeholders with the largest concentration coming from the Banking, Secured Credit, and Unsecured Credit sectors.

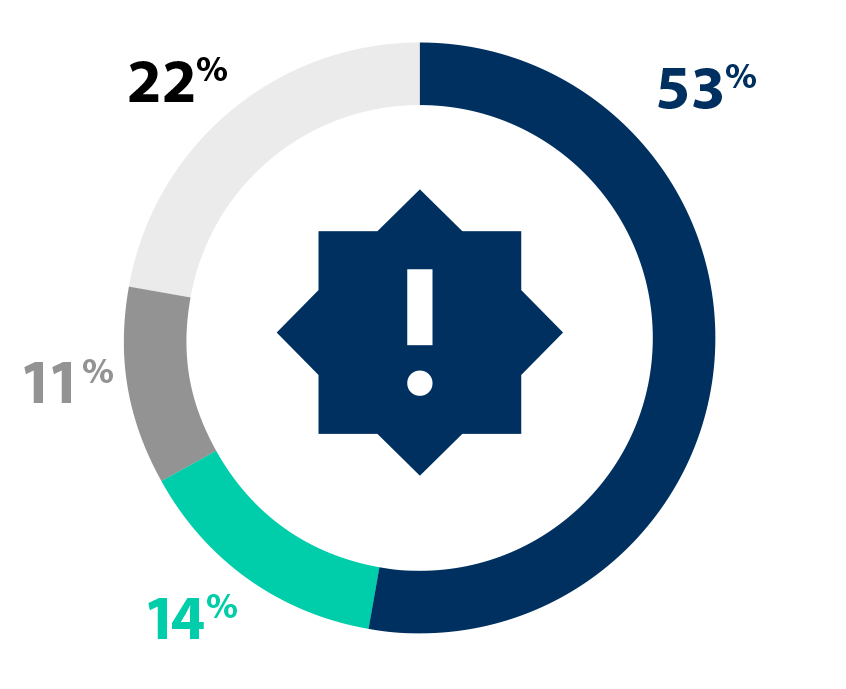

The average number of monthly disputes reported:

By industry group, Unsecured Credit providers and servicers manage the most monthly disputes.

About PMG

PMG, a leader in workflow automation for over 25 years, developed Case Central® for Dispute Management specifically for consumer credit data furnishers. Offered as a secure SaaS application, Case Central supports full compliance with FCRA Reg V guidelines while empowering investigation teams to process disputes 2.5x faster. With an emphasis on user experience, Case Central supports both direct and indirect disputes, and provides a single interface for executing all dispute-related activity. Best of all, evidence for any investigation can be provided in an easy-to-read format with just one click.